american working in canada taxes

Here are three major tax implications that Americans working in Canada should know about. Do expats pay taxes in Canada.

Measuring The Distribution Of Taxes In Canada Do The Rich Pay Their Fair Share Fraser Institute

ProvincialTerritory tax rates top out from 115 to 2575 Ontario has surtax of 20 and 56.

. Tax return every year regardless of where they live or work. Do Americans working in Canada pay Canadian taxes. They are taxable only in Canada.

Unless you are sure about the tax laws and how you fit into the scheme of things as an American working in Canada you will end up being a victim of double taxation. While in the US its based on both. Residents Living or Working in Canada 1 101 Introduction.

The tax filing season is similar to the US. In Canada employees pay 495 of their taxable income into CPP and medical benefits are. A non-resident is usually required to pay Canadian tax only on Canadian sources of income.

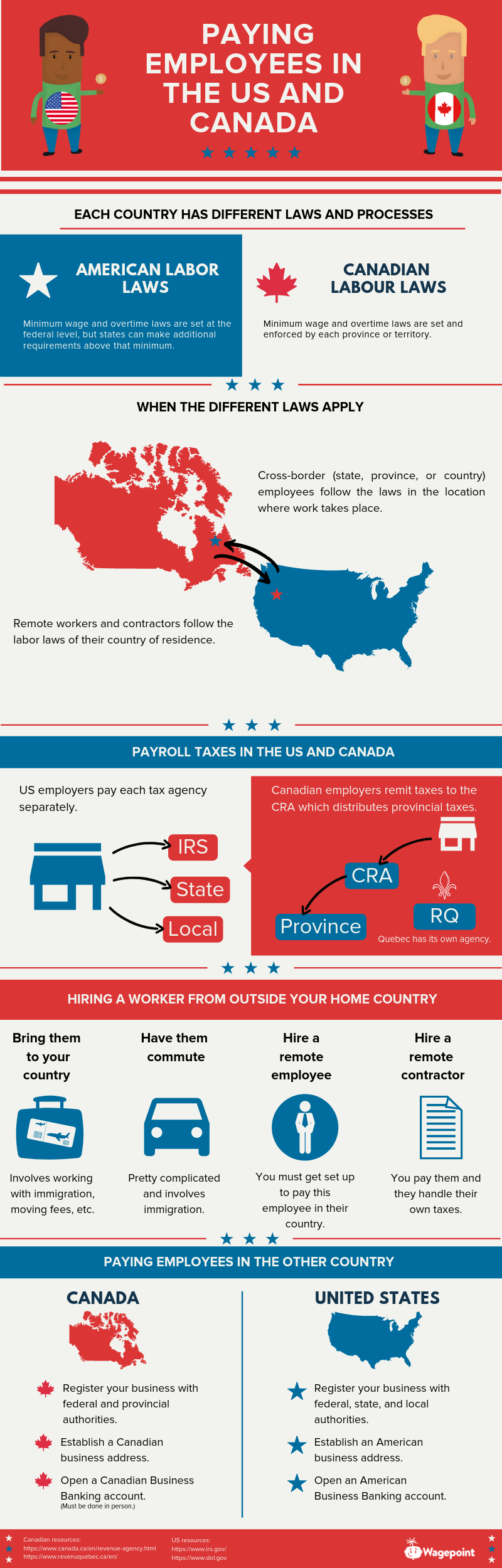

Bases taxation on both your residence and citizenship status. If the Facebook employee spent over 183 days in Canada in 2020 he will need to pro-rate the number of days worked in Canada and pay tax on the portion of his salary to CRA. Employers with employees working remotely in Canada are required to collect and remit payroll taxes to CRA unless they qualify to not withhold under a Regulation 102.

Do Americans working in Canada pay Canadian taxes. A 15 deduction can be claimed on. Income Taxation of Citizens Residents 2 a Taxation of Individuals 2 b Itemized.

In this topic we will. However under the income. Citizen who resides in Canada could be obligated to pay taxes on his worldwide income in both countries.

This means American citizens must file a US. The main difference between Canadian income tax and American Income tax is the fact that in Canada its based upon residents working in Canada. American employees pay 765 of their taxable income into social security and Medicare.

Citizen working and living in Canada yes you may also have to file Canadian. Its easy to see how these rules could lead to an absurd result a US. Tax year but with a few differences.

Citizen receives Social Security benefits from the USA these benefits are not taxable in the US. This means that if a US. While the US-Canada Tax Treaty doesnt stop Americans in Canada having to file both American and Canadian taxes it does contain some significant provisions.

You will be taxed differently if you are moving to Canada permanently.

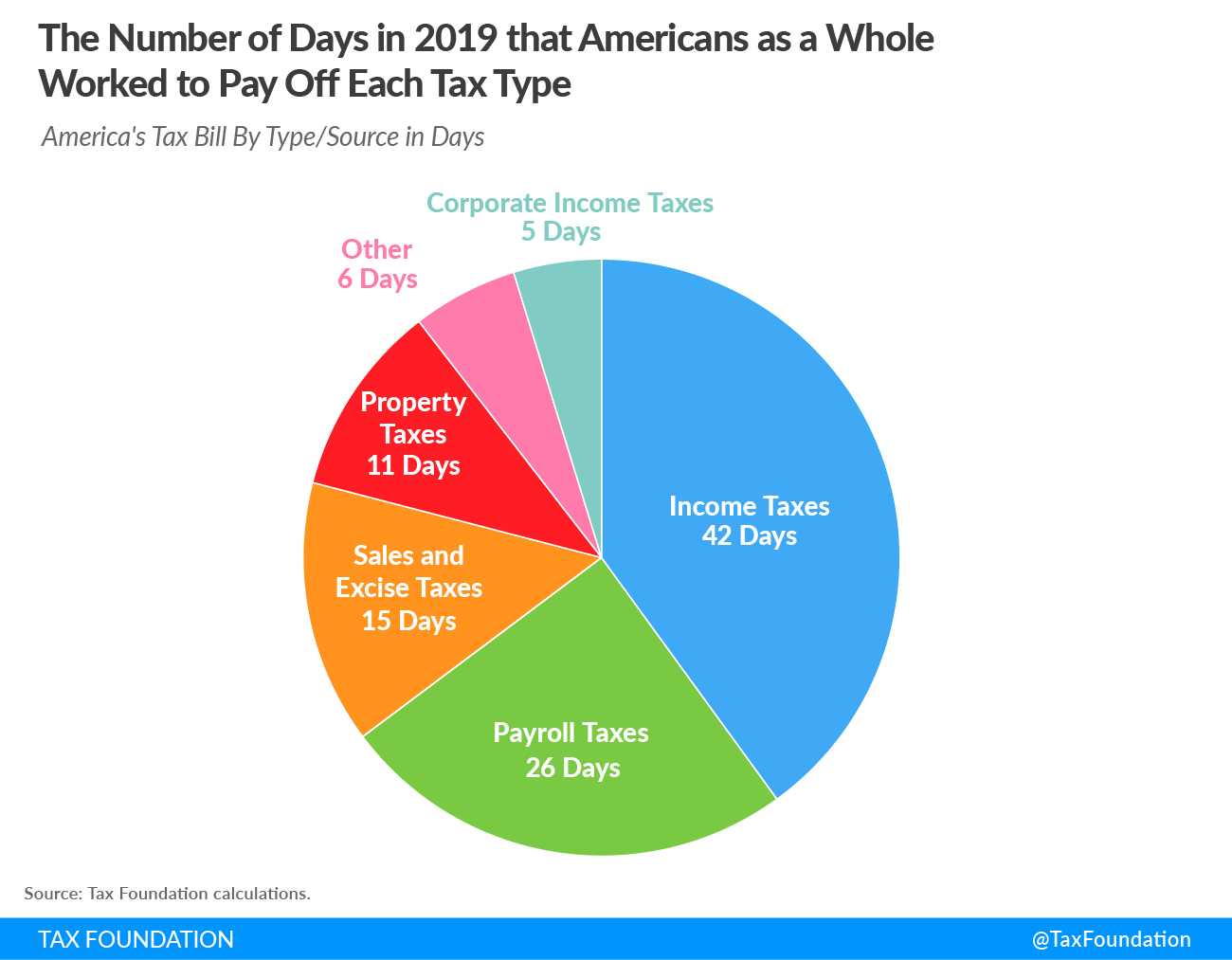

Tax Freedom Day Tax Foundation

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

Canada Vs U S Tax Rates Do Canadians Pay More

Us Tax Issues For Us Citizens And Green Card Holders Living In Canada Djb Chartered Professional Accountantsdjb Chartered Professional Accountants

A Tax Guide For Americans In Canada Remote Swap

Tax Implications For Us Citizens Working In Canada Madan Ca

Paying Employees In Canada And The Us What You Need To Know Smallbizclub

How Do Federal Income Tax Rates Work Tax Policy Center

Us Vs Canada Tax Revenues Breakdown Tax Policy Center

Can Us Citizens Work In Canada

Us Income Taxes For Canadian Businesses Which Forms To File

Foreign Account Tax Compliance Act Fatca Us Citizens In Canada

Americans Working In Canada And Taxes

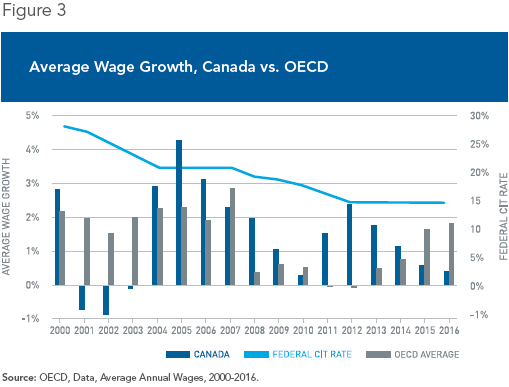

Canada S Corporate Tax Cut Success A Lesson For Americans Iedm Mei

Canada Vs Usa Which Country Is Better To Settle For Indians In 2022

Usaexpattaxes Official Homepage Fliphtml5

Consumption Tax Policies Consumption Taxes Tax Foundation

10 Things To Know Before Moving To Canada From The Us

How Do Us Taxes Compare Internationally Tax Policy Center

Canada S Personal Income Taxes On Highly Skilled Workers Now Among The Highest In Industrialized World The Nelson Daily